/reboot/media/cb1ca522-65d6-11ef-8660-0242ac120010/39cb73ee-8742-11f0-b3d6-1a3d8e5696a4/1-1-1756737883173.png)

Case study: Agile concepts screening for a biscuit brand

Our client's requirements

In order to prepare its innovation plan, our client came up with a large number of new biscuit concepts and wanted to know which ones to prioritise. The challenge was twofold:

- Rank the concepts according to their appeal, their ability to attract new consumers and retain existing buyers.

- Compare these innovations to market benchmarks and its current range, taking into account the diversity of targets (purchasers of the brand vs. other brands, age targets)

in order to select the most promising innovations for a rapid and effective launch for the brand.

The challenge for us was to propose an agile protocol that would provide understanding and clearly identifiable levers for optimisation (not just a go/no go approach), with a tight budgetary constraint as our client had less than €20k for this test.

Repères solution

We proposed a hybrid quantitative concept test, combining:

- An agile protocol given the number of concepts to be tested:

- Online Sequential monadic test

- Each respondent evaluated 6 concepts out of 19 (15 innovations + 4 benchmarks), according to an experiments plan design

- Representative sample of 780 buyers of the category (women and men, aged 18‑65).

- A dual evaluation:

- Rational: purchase intention, brand fit, differentiation, consumption moments.

- Emotional (R3M Score®): analysis of the three spontaneous words expressed by respondents for each concept, translated by an algorithm into a level of emotional activation to understand the emotional drivers of each concept

- Segmentation of respondents by speed of adoption: pioneers, followers, latecomers, reluctants. This analysis made it possible to identify which concepts really activate innovation players (those who are quickest to adopt innovations) and which ones struggle to appeal beyond the core target audience.

Insights

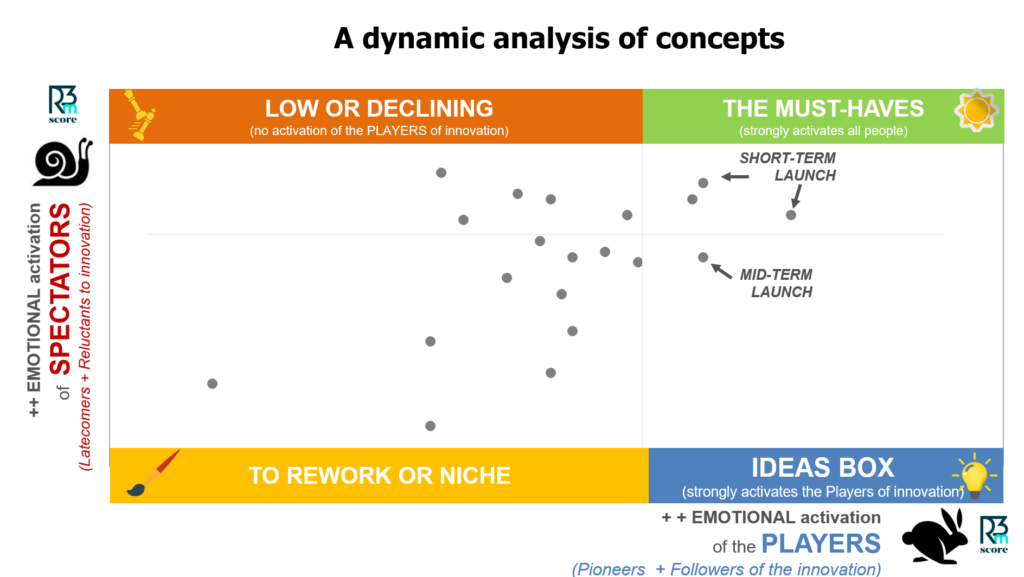

This methodology allows concepts to be classified into 4 categories:

- Must haves: strongy activate all populations.

- Idea box: strong among innovation drivers.

- To rework or niche: polarizing or perceived negatively.

- Unpromising or declining.

Our analysis clearly distinguished between winning ideas and concepts that needed further work:

- Immediate growth drivers: certain concepts stood out as real must‑haves thanks to their ability to appeal to all target audiences and attract customers beyond the current core customer base.

- An opportunity for image and modernity: thanks to a disruptive concept capable of modernising the range and adding a ‘healthy and original' touch (but with recommendations for optimisation to remove certain perceived barriers).

- Risky, reworked or overly niche concepts: certain promises or formats lack originality and suffer from poor differentiation, preventing them from creating added value.

Added value for the client

For our client, this concept test was a valuable strategic management tool:

- Make clear and secure decisions: prioritise four innovations with strong potential for launch in the short term.

- Optimise innovation discourse: understand emotional drivers and barriers in order to reposition more polarizing concepts.

- Strengthen brand legitimacy: validate that its pillars remain its best assets, while opening the door to selective modernisation opportunities.

- Anticipate market dynamics: by incorporating the speed of adoption by different targets, the study measured not only immediate interest, but also medium‑term dissemination potential.

👉 In summary, Repères approach transformed a portfolio of innovations into a concrete, prioritised and predictive action plan, giving our client the keys to invest in the concepts that create the most value.

Contact us if you would like to find out more!

/reboot/media/cb1ca522-65d6-11ef-8660-0242ac120010/cfdfa59a-8737-11f0-8a4f-1a3d8e5696a4/1-1-1756733410582.png)

/reboot/media/cb1ca522-65d6-11ef-8660-0242ac120010/782e348a-460d-11f0-a6b4-ca83f24d1f3e/1-1-two-sliced-lemons-on-surface-443wmczewem.jpg)

/reboot/media/cb1ca522-65d6-11ef-8660-0242ac120010/381d59cc-3d01-11ef-bfa3-0242ac120012/1-1-download.jpg)